Finding the best multifamily loan interest rates in February 2025's dynamic market requires careful planning and a strategic approach. This guide provides a step-by-step process for securing optimal financing, minimizing risk, and maximizing your return on investment.

Understanding the February 2025 Lending Landscape

The multifamily lending environment in February 2025 is characterized by higher interest rates than in recent years, reflecting broader economic conditions. However, this also presents a wider range of lender options, including GSEs, banks, and private lenders, each with unique rate structures and risk profiles. Your individual interest rate will depend significantly on factors like loan-to-value ratio (LTV), property type, and credit score. A strong credit history and lower LTV are key to securing favorable rates. Are you prepared to leverage these factors to your advantage?

Decoding Your Loan Options: Choosing the Right Lender

Three primary lender types dominate the multifamily lending market:

Government-Sponsored Enterprises (GSEs): Fannie Mae and Freddie Mac offer competitive rates but have stricter lending requirements. They represent a reliable, albeit less flexible, option.

Banks: Banks provide more flexibility than GSEs, but may offer slightly higher rates due to increased risk assessment. They're often more accommodating to unique property characteristics or financial situations.

Private Lenders: These lenders cater to complex deals and non-standard properties. While they can offer creative financing solutions, their rates generally reflect the higher associated risk.

Key Drivers of Multifamily Loan Interest Rates

Several crucial factors determine your multifamily loan interest rate:

Macroeconomic Conditions: The overall economic health, particularly government bond yields, significantly influences interest rates.

Loan-to-Value Ratio (LTV): A lower LTV (higher down payment) typically results in lower interest rates.

Property Desirability: Prime locations and attractive properties command lower rates due to reduced lender risk.

Credit Score: A higher credit score signals lower risk to lenders, leading to more favorable rates.

Loan Term: Longer loan terms might offer smaller monthly payments but typically come with higher overall interest.

Loan Type: Recourse loans (where borrowers are personally liable) generally carry higher interest rates than non-recourse loans.

Your Step-by-Step Guide to Securing the Best Rates

Follow these actionable steps to optimize your loan application and secure the best possible interest rate:

Pre-qualification: Engage multiple lenders to gauge borrowing capacity and potential interest rates before formally applying. This allows for informed comparison-shopping.

Comprehensive Comparison: Analyze total loan costs, including fees and terms, not just interest rates. Utilize spreadsheets to facilitate this detailed comparison.

Negotiation: Don't hesitate to negotiate with lenders to secure a more advantageous rate.

Thorough Review: Meticulously review all loan documents before signing. Seeking legal or financial counsel is prudent.

Efficient Closing: Ensure your paperwork is complete and organized for a smooth closing process.

Navigating Risks: Protecting Your Investment

Certain loan scenarios present higher risk:

High LTV Loans: These pose increased risk to lenders due to the larger loan amount relative to property value.

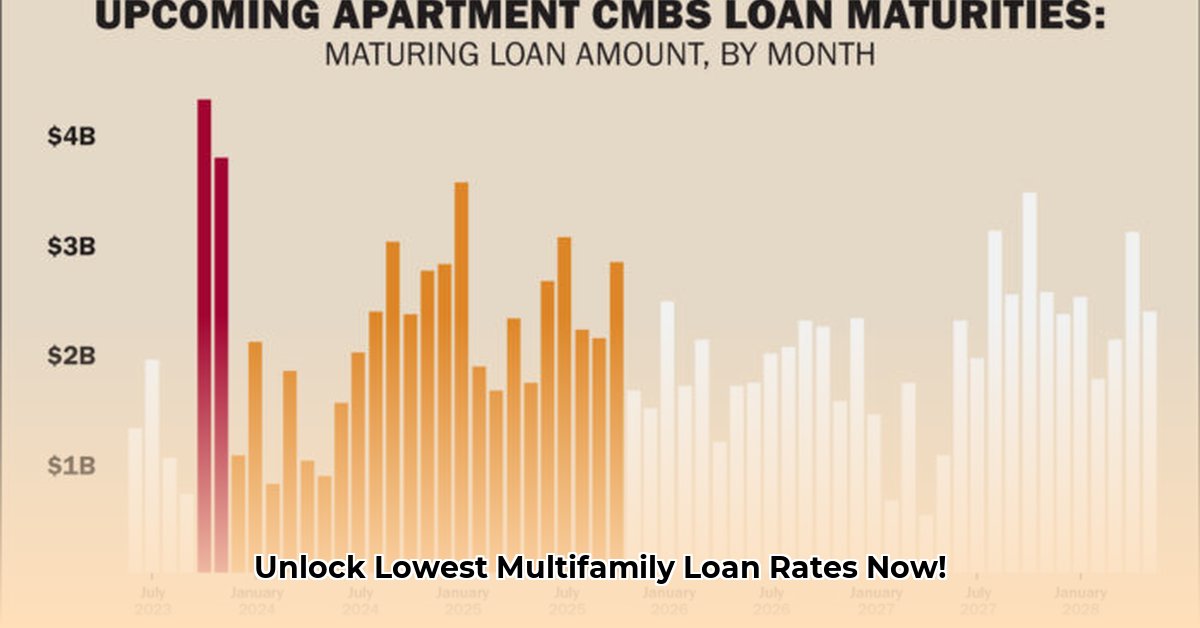

Commercial Mortgage-Backed Securities (CMBS) Financing: Market volatility inherent in CMBS loans requires careful consideration.

Construction Loans: Unforeseen delays and escalating costs make construction loans inherently riskier.

| Risk Factor | Mitigation Strategies |

|---|---|

| High LTV Loans | Increase down payment; explore strategies to enhance property value. |

| CMBS Financing | Conduct thorough market research; diversify funding sources; understand market volatility. |

| Construction Loans | Obtain detailed cost estimates; establish a contingency fund; select a reputable contractor. |

Hedging Interest Rate Risk in Multifamily Financing

While securing a favorable initial interest rate is crucial, effectively managing interest rate risk throughout the loan term is equally important. This requires understanding and potentially employing hedging strategies.

Analyzing Your Risk Profile

Before implementing hedging strategies, analyze your risk exposure. This includes evaluating your loan type (fixed-rate vs. adjustable-rate mortgage (ARM)) and loan term. ARMs are more susceptible to interest rate volatility whereas longer-term, fixed-rate loans offer rate certainty but might have higher initial interest rates. Understanding your risk appetite is paramount.

Exploring Hedging Strategies

Several strategies can mitigate interest rate risk:

Interest Rate Caps: Limit potential interest rate increases on variable-rate loans.

Interest Rate Swaps: Involve exchanging interest rate payments with a counterparty to adjust loan rates (fixed to variable or vice versa). Requires specialized financial market knowledge.

Fixed-Rate Financing: Eliminates interest rate risk but often comes with higher initial interest rates.

Important Considerations:

Regulatory Compliance: Adherence to regulations (e.g., Fannie Mae guidelines) regarding hedging strategies is non-negotiable.

Costs: Hedging involves associated costs that must be weighed against potential benefits.

Complexity: Seeking professional financial advice is crucial for understanding and implementing complex hedging strategies.

Operational Efficiency: A Complementary Strategy

Improving operational efficiency complements your interest rate management strategy by directly enhancing profitability and resilience to market changes. Consider:

Energy Efficiency Upgrades: Reduce operating costs.

Technology Integration: Streamline operations and reduce expenses.

Tenant Retention: Increase occupancy and reduce turnover costs.

A Proactive Approach

The multifamily real estate market is dynamic; proactive interest rate risk management is essential. By combining the steps outlined in this guide with a thorough understanding of your individual risk and an appropriate hedging approach, you can achieve optimal financial outcomes in February 2025’s competitive landscape. Remember, this is a highly technical field; consult experienced professionals as needed.